Mastering Financial Analytics: Leveraging Data Insights for Business Growth

Introduction:

In the ever-evolving landscape of accounting and financial management, data is the new currency. Accounting firms are no exception to this digital transformation, and financial analytics has emerged as a game-changer in driving business growth and strategic decision-making. In this blog, we will delve into the significance of financial analytics for accounting firms, exploring how leveraging data insights can transform raw information into actionable strategies.

The Power of Financial Analytics: Financial analytics is not just about number crunching; it’s about uncovering hidden opportunities and potential challenges within your financial data. It involves collecting, processing, and analyzing financial information to gain a deeper understanding of your firm’s operations, clients, and market trends. Here are the key benefits:

Informed Decision-Making:

Financial analytics equips accounting firms with data-driven insights. It empowers decision-makers to make informed choices, whether it’s about resource allocation, pricing strategies, or identifying growth opportunities.

Efficiency and Productivity:

By analyzing financial data, firms can pinpoint areas where efficiency can be improved. This includes identifying cost-saving opportunities, optimizing workflow, and streamlining operations.

Risk Mitigation:

Financial analytics helps in identifying potential risks and vulnerabilities. By monitoring key financial metrics, firms can proactively address issues and make necessary adjustments.

Client Insights:

Understanding your clients’ financial health and needs is crucial. Financial analytics allows firms to gain insights into client profitability, assess client loyalty, and tailor services to meet individual client requirements.

Competitive Advantage:

Firms that harness the power of financial analytics gain a competitive edge. They can adapt swiftly to market changes, stay ahead of the competition, and offer more value to their clients.

Redefining Client Engagement: Nurturing Strong Relationships in the Digital Era

Best Practices for Data Analysis: Effective financial analytics involves more than just collecting data; it requires a structured approach. Here are some best practices to consider:

Data Quality:

Ensure the data you collect is accurate and consistent. Clean and standardized data is the foundation for reliable analysis.

Define Clear Objectives:

Know what you want to achieve with your financial analytics efforts. Setting clear objectives guides the analysis process.

Use the Right Tools:

Invest in suitable financial analytics tools. Choose software that aligns with your firm’s needs and provides the necessary features for data analysis.

Regular Monitoring:

Financial data is not static. Regularly monitor and update your data to ensure that the insights remain relevant.

Cross-Functional Teams:

Collaborate with cross-functional teams. Combining financial experts with data analysts can yield more comprehensive insights.

Looking for Personalized Experiences: CAOA’s White Label Solution for Tailored Accounting Services

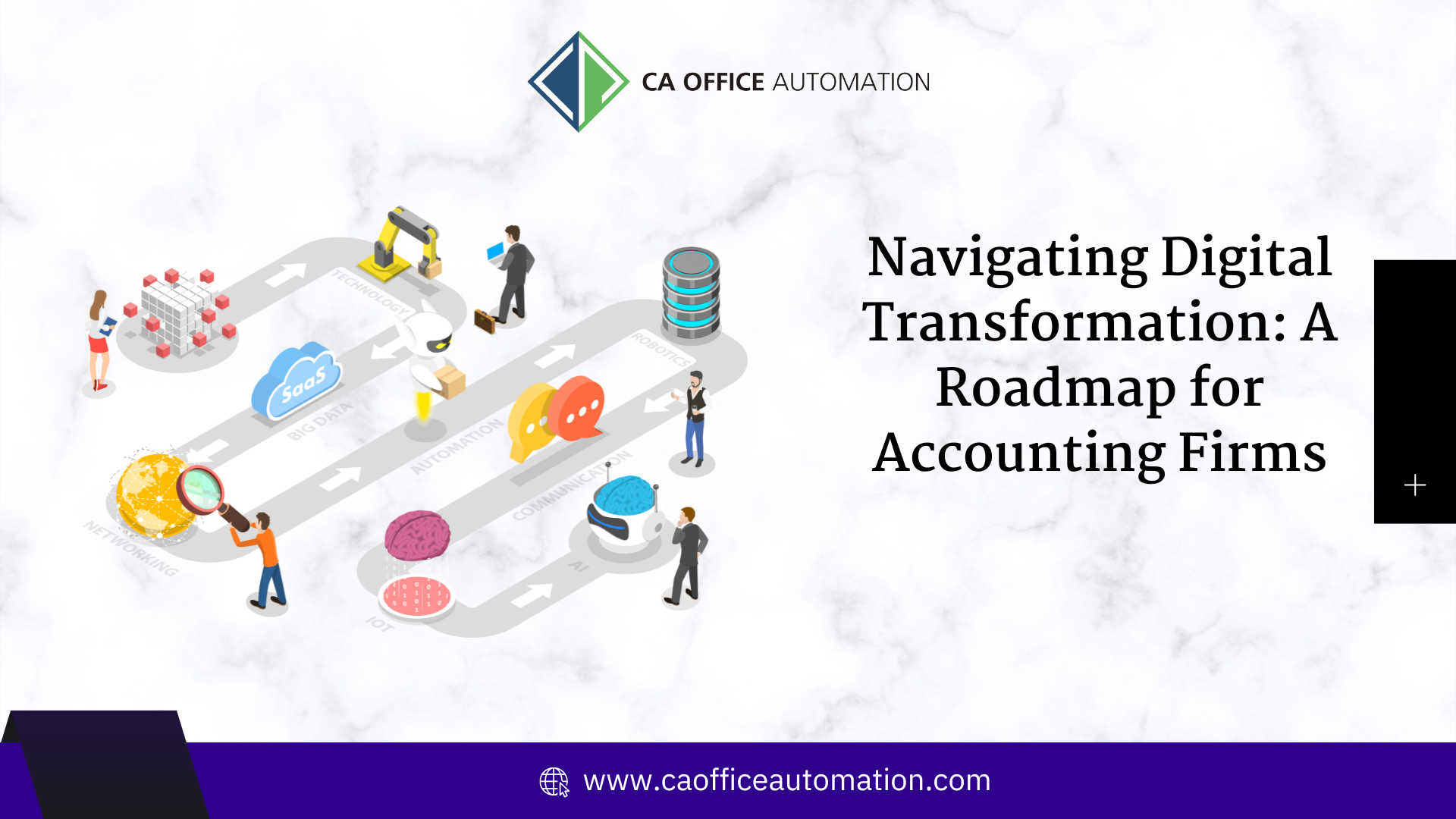

Transforming Data into Actionable Strategies: Leveraging financial analytics tools and insights is just the first step. Transforming data into actionable strategies requires a strategic approach. Here’s how accounting firms can achieve this:

Identify Key Performance Indicators (KPIs):

Focus on the most relevant KPIs that align with your firm’s objectives. Whether it’s profitability, client retention, or operational efficiency, prioritize the metrics that matter most.

Data Visualization:

Use data visualization tools to present your findings. Visual representations make complex data more accessible and understandable, facilitating quicker decision-making.

Scenario Planning:

Explore different scenarios and potential outcomes based on your analysis. This helps in developing strategies that can adapt to various situations.

Feedback Loops:

Implement feedback loops to continuously improve your strategies. Regularly assess the impact of your actions and adjust as needed.

Conclusion: In today’s digital age, mastering financial analytics is no longer an option; it’s a necessity for accounting firms. By leveraging data insights, firms can drive business growth, enhance efficiency, and make informed decisions. Financial analytics empowers firms to gain a competitive advantage, mitigate risks, and provide better client services. It’s a transformative journey from raw data to actionable strategies, and it’s a journey well worth embarking on.