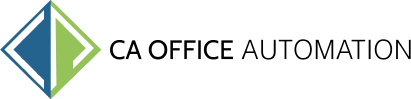

Accounting that traditionally has been heavily reliant on manual processes, is witnessing a surge in adopting automated solutions in recent times. To save cost and time, companies have been deploying technologies to scale operations and optimize their workflow. Technology deployment has proved to be crucial in increasing productivity, reducing human error, and enabling your staff to focus on strategic tasks. Automated solutions are replacing traditional time-consuming and manual tasks of essential accounting departments such AP/AR, payroll, tax to make the best use of their resources.

Here are the four accounting processes your business should automate to save costs and time:

Accounts Payable

- Data-entry

- Approval follow-up

- Looking for lost or missing invoices

- Filing, and resolving discrepancies

Fortunately, these challenges can all be addressed with automation. With CA Office Automation you can

- process payments electronically eliminating high-cost repetitive tasks

- speed up the invoice process and eliminate 83% of manual data entry

- move your entire account payable process into the cloud, so that remote or geographically separated teams can all access it

- reduction in errors and duplicate payments

- mitigate major risks such as fraudulent payments

Accounts Receivable

For most businesses, one of the biggest challenges is receiving payments in time. This also includes some of the manual processes like preparing invoices and delivering them to clients on a custom set schedule, depositing checks, and waiting for funds to settle.

With automated tools and features, your account receivable team will be able to remove the hassles and anxiety around collecting payments in time. You can ensure everyone – including your account management and customer service team that the collections process is up to date with the real-time status of payments.

Here’s how your accounting organization can benefit from automated Accounts Receivable process:

- No need to spend time updating the spreadsheets

- Don’t have to hunt customer information

- Easy access to key performance indicators

- Removes the costs accruing from printing and posting in-house invoices

Payroll

The amount of data processing that goes into payroll can get challenging. Inconsistency and mistakes within a payroll system can have complex consequences, often resulting in deterioration of trust in the company. Payroll systems are often complicated by factors like:

- Manual paycheck writing

- Attendance records are processed manually

- Manual computing of salary and wage deductions

Here’s how you can empower your payroll system with the right set of automation tools and features:

- Computerized employee attendance management

- One-click salary calculation facility with salary slips and auto-notification system

- Generate paychecks enables direct deposit

Audit

Traditional methods of the audit include lots of mundane and repetitive tasks like file organization, integration of data from multiple files, audit data preparation, the performance of basic audit tests in Excel, copying and pasting data, and it goes on and on and on. All of these processes are extremely time-consuming, tiring, monotonous, and error-prone.

But now all these constraints can be overcome and turned into a benefit if the companies and their CA/CPAs deploy automated tools and features. All these traditional audit processes can be restructured and simplified to a great deal by using computerized and automated tools.

Automation technology can help accounting practices to enhance the quality of audits by automating structured audit tasks which are rule-based, repetitive, and manual.

Some of the main benefits of automating the audit process are that it helps in:

- Streamlining the process

- Accelerating the pace by reducing time spent on manual activities

- Detecting and amending the mistakes instantly within the system

- Making records and numbers highly traceable and auditable

- Track evidence and financial workflows in real-time

Parting Advice

While automating these accounting processes will bring many advantages to your accountancy practice, we understand that you may feel daunted by the idea of experimenting with new tools and adopting them. So, what can you do to smooth the process of automating your practice? Here’s how we can help you! We have created a real use replicating video that shows the CAOA platform in action. Using real scenarios resembling data, the video will demonstrate all the features of the CAOA platform in detail. Watch this video now.