Many industries use technology to automate all the time-consuming and repetitive work. These are the places where human error can be a real problem. Accounting is no exception. We have tools to replace lengthy ledgers that pull in bank feeds and reconcile for us. Automation technology in accounting streamlines recording, completing, reconciling, and reporting. Accounting automation is made for accountants gives them more time to do what only humans can do.

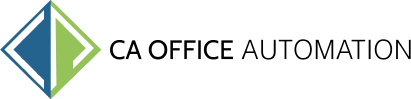

Automation is going to have a long-term effect on accounting and some of the effects we cannot predict. Here are some of the popular myths that stopping accounting professionals from adopting automation technology in accounting. It’s time to bust them!

MYTH 1: I don’t need Accounting Software

Accounting consists of more functions than most people realize. From billing customers to paying vendors, to tax accounting and reporting, accounting is what keeps your business in control. The numbers don’t just need to be accurate; they also need to be easily accessible. Therefore, you can’t just rely on spreadsheets. To maximize your time and accounting data quality, you really need accounting software.

You can automate invoicing and recurring bills through billing automation.

Studies show that companies who invest in accounting software were able to add five times more clients than companies who didn’t implement these tools. In 2020, 58% of large companies and 78% of small businesses used accounting automation software. On top of that, businesses that use cloud accounting services have displayed 15% year over year revenue growth.

MYTH 2: Automation Only Benefits Businesses of Certain Size

Maybe you’ve gone through the internet and researched cloud accounting technology considered it for your small business, and concluded that automation tools are only beneficial only for larger organizations. Or perhaps the cost and expenses associated with implementing the technology and moving your data to the cloud have deterred you from investing in automation technology. But the reality is completely different.

For example, if you are a small business owner with a limited number of invoices generated every day, you can benefit from the automatic GST filing and reconciliation. What can take hours of manual work of matching your invoices and then uploading it to the GST portal, can now be done automatically for you.

Taking other situations into consideration, if you are an accountant that serves a growing business with hundreds of transactions in a day, you can benefit from automation with the help of API integration. Once all the APIs are in place, invoices can be automatically generated and sent to the customers from you and an entry would be made against the purchase automatically.

MYTH 3: Accountants will be substituted by Technology

Although quite often the accountancy industry has dealt with the question of whether accountants will be sidelined by technology, the discussion has now moved on to the adaptation of the much-talked digital age. Hence, instead of being worried, CAs and accountants must focus on their roles as they will be changed but not completely substituted.

Analytics and reporting might entirely be controlled by business accounting software sooner or later, but accountants in the industry need to possess the ability to utilize the data created by technology to aid clients and in making informed business decisions, including pricing strategy, growth model, and risk identification.

It can be noted that though the pace of technical developments is alarming, human intelligence and interpersonal skills can never be replaced by any advanced technology.

Certified Charted Accountants and accounting professionals need to be self-assured with technology and develop their skills outside of the traditional statistical tasks. They must be able to look at the bigger business picture where the coexistence with accounting technology can take the place, rather than limiting themselves to just one part of an organization i.e. Accounts, which will majorly be digitized.

MYTH 4: Firms have doubts about the security of clients’ sensitive financial or proprietary data in the cloud.

Today’s advanced cloud technology provides greater security than most firms can afford with internal servers. That’s the reason why 96% of organizations now use some or other form of cloud computing.

MYTH 5: Automation Will Take Away Your Control of Accounts

Automation features work for us. For example, you can set the invoicing on autopilot and focus on the core business functions that need your attention. It’s you who will be deciding what to automate and what you don’t. The control to set things on automates ultimately stays with you. This means you are in control at which aspect of your accounting you want to automate and to which extent.

Automation and accounting will always go together. It’s the partnership of both that will enable us to take our heads out of the general ledger and advise our clients on what they need for their businesses to truly succeed.

Does Your Firm Have One Plan to Automate Workflows?

CAOA has tons of features to automate your work processes, & help you manage your work, employees, clients, billing, payment, payroll, communication, documents, meetings, follow-ups, due dates & many other processes under a single dashboard delivered on a blazing fast web platform & a mobile app.

Request For Free Demo Now.